.

Until now, manufacturers outside EU with environmentally burdensome production methods have, somewhat paradoxically, enjoyed a noticeable financial advantage. To address this imbalance, the European Union has developed the CBAM, designed to ensure that manufacturers outside the EU carry their fair share of financial responsibility for their CO₂ emissions. Up until 1 January 2026, only producers operating within the EU have had to comply with strict emissions limits and compensate for their emissions through the EU Emissions Trading System. The CBAM applies to products such as steel, iron, aluminium, fertilizers, cement, electricity, and hydrogen.

CBAM After 1 January 2026

Starting from this date, importers of steel into the EU will need to purchase CBAM certificates. In practice, this means compensating the manufacturing-related CO₂ emissions, just as has been done so far with European steel. The number of certificates required depends on the country and plant of origin of steel production, while the price per tonne of emissions is aligned with the price of CO₂ in the EU Emissions Trading System.

The mechanism does not apply when goods are not formally released for free circulation in the EU,for example in cases of temporary import or inward processing.

How the Calculation Works (and Why It’s Not Entirely Simple)?

The calculation contains multiple variables, some of which are still awaiting full clarification.

A default certificate value is first assigned to each origin country based on its average emissions. These values are reached by comparing the country’s data to EU benchmark levels for the relevant product group.

Furthermore, some countries operate their own emission pricing or reduction systems, and these must also be taken into account. On top of that, existing EU available allocation of emission allowances is factored in although these allowances will gradually decrease and will disappear entirely by 2034.

But just in case things seemed too straightforward, steel mills may also apply for adjustments to their country’s default emission values. Any such changes, however, must be verified and approved by an officially accredited and independent body. At the time of writing, neither these bodies nor the final approval process have yet been formally defined.

Where Things Stand Now

Things have a way of sorting themselves out one way or another, and so will this. The transition period is officially over: the CBAM is real, and the obligation to acquire certificates has begun.

The 2026 carbon emission certificates must be surrended no later than September 2027, and thereafter payments will follow a quarterly cycle. The first year 2026 may be somewhat chaotic and could bring a few surprises.

Practical Tip

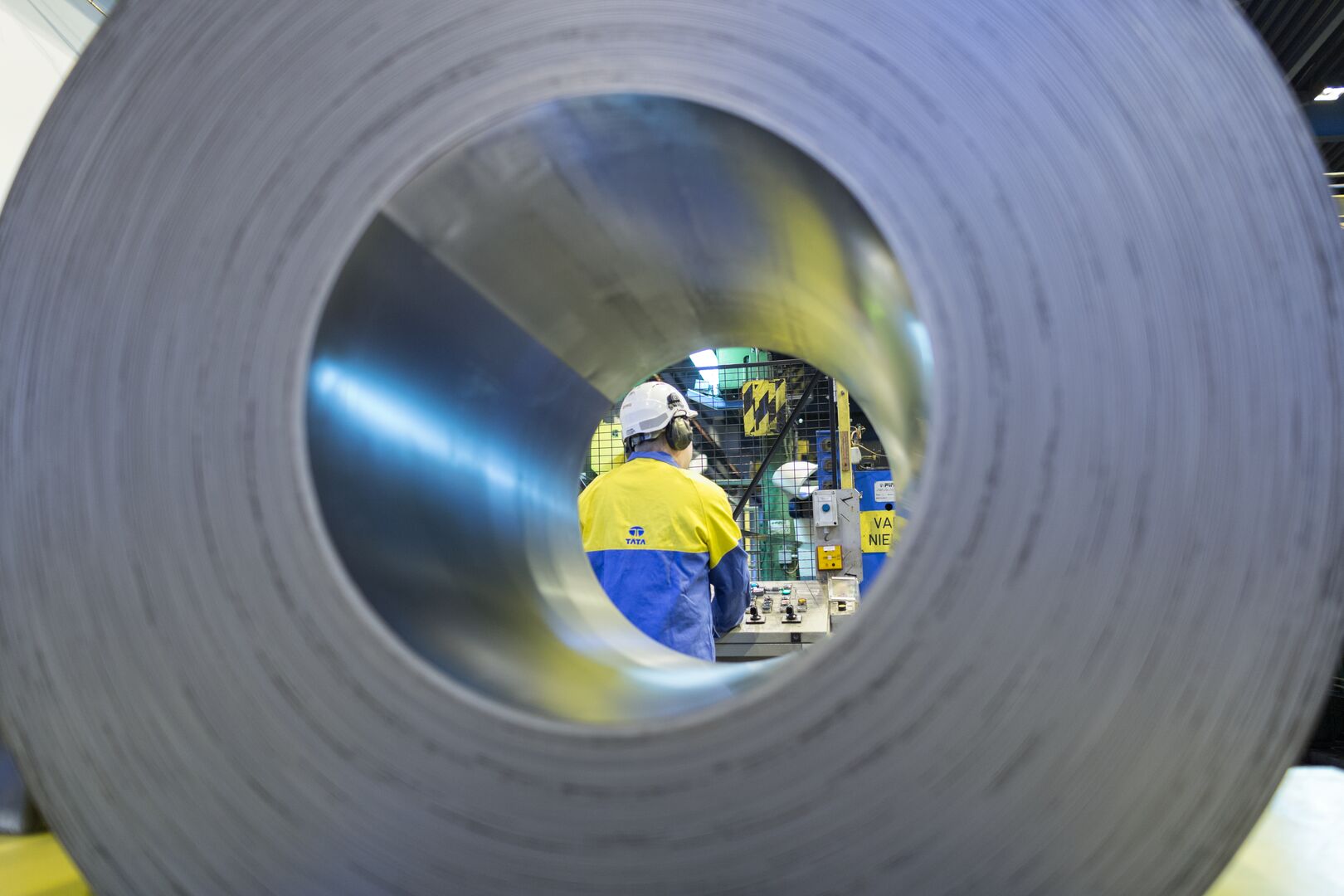

If you want to play it safe, and avoid risks in multiple senses of the word, here’s a simple piece of advice: Buy European steel.

SOURCES:

https://www.eurofer.eu/assets/publications/brochures-booklets-and-factsheets/fix-that-leak/CBAM-Facsheet-EUROFER.pdf

https://tulli.fi/en/carbon-border-adjustment-mechanism

https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en