What impact is the coronavirus crisis having on the steel industry and its customer markets, and how can they respond? What about the challenges of globalisation, sustainability and digitalisation? These were key topics at the Tata Steel hosted live panel forum event called Let's talk about the future. Speakers included international experts from the steel, automotive and heavy vehicle industries.

With the theme Let's talk about the future, industry experts, decision-makers and thought-leaders from four EU countries and China came together on 22 October live at the Tata Steel studio in IJmuiden, the Netherlands, and via video. Watch the full event here.

With host Karl Haider, Chief Commercial Officer of Tata Steel Europe, and moderator and trend researcher Markus Moll from the steel consultancy SMR, four other industry experts were represented on the panel: Edwin Basson, Director General of worldsteel from Brussels, Michel Van Hoey, Senior Partner at McKinsey & Company in Luxembourg, Alex Woodrow, Managing Director at the management consultancy Knibb, Gormezano and Partners in the UK and an expert on the commercial vehicle sector, and US-born automotive specialist Bill Russo, CEO of Automobility Ltd. and Chairman of the Automotive Committee of the American Chamber of Commerce in Shanghai.

The panel discussion was introduced with a debate on the impact of the coronavirus crisis on the steel industry. While global steel production has shrunk by only around 2% in 2020 due to a fast recovery in Chinese demand, the picture differs across regions and industries. While Tata Steel has even been able to experience a slight uptick in its packaging segment in 2020 – mainly as a result of changes in European consumer habits – in other product areas such the automotive and off-highway sectors, like its competitors, it has had to respond to a downturn in demand. Edwin Basson of worldsteel estimates the recovery of the industry will take place more quickly than expected, although a return to 2019 demand levels will probably take 18 to 24 months.

The automotive and off-highway vehicle industries in particular faced a sudden and almost complete drop-off in global markets. However, none of the experts believe this calls globalisation into question. Manufacturers would typically have to reevaluate their approach and involve more regional suppliers in their portfolio.

“We have learned as much in the past five months as we’d normally learn in five years, and at the moment we are still driving by sight, so to speak," said Karl, about the changes experienced during the pandemic. "We knew we were already pretty flexible, but we have to all become even more agile. This doesn’t mean totally new ideas. Rather, existing initiatives to digitalise the industry now need to be pushed forward.”

Smart solutions needed for sustainable processes

The steel industry is working intensively on solutions for even more sustainable and CO2-neutral production methods as calls from end consumers and governments grow. In finding solutions, the use of alternative energies plays just as crucial a role as new process technologies. But even here, there is no magic bullet. Commercial vehicle specialist Alex Woodrow, for example, emphasised how important it is to make sure a full range of existing and yet-to-be-developed sustainable powertrain concepts are adopted, depending on the vehicle type and area of application, in order to achieve an optimal environmental balance.

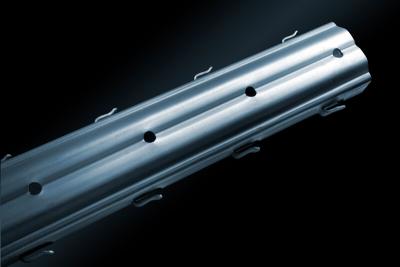

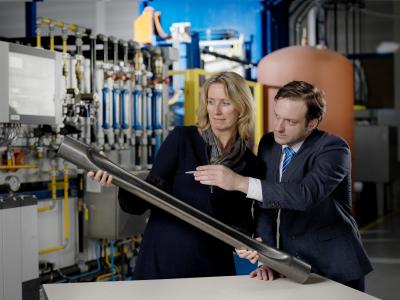

At Tata Steel, Karl said the company is looking to achieve a 30% reduction of its CO2 output by 2030. The plans to achieve this have progressed significantly and include upscaling Tata Steel’s breakthrough HIsarna technology - an alternative to blast furnaces which does not require coke and can reduce energy consumption and CO2 emissions by up to 20%. But with CCUS (Carbon Capture Utilisation and Storage) this rises to 80%. By 2028, the IJmuiden plant, in the Netherlands will use former natural gas fields in the North Sea for this. Longer term, the company sees sustainably-produced hydrogen as a CO2-neutral energy source and already has plans, with partners, to build a pilot plant to develop the infrastructure.

So who in the end should pay for these initiatives to achieve greater sustainability? Michel Van Hoey of McKinsey & Company pointed out that steel production costs can be expected to increase by up to 70%. For the purchase of an average passenger car, for example, this would mean additional costs of around €400 to cover its share of low-CO2 steel.

Digitalisation even more critical

The coronavirus crisis has evidently pushed digitalisation forward and it’s clear no company can ignore this. This was also confirmed by delegate polls held during the panel forum. According to Michel Van Hoey, the steel industry has an image of not being particularly progressive in this area. However, the fact is that among the 44 plants that were named "Factory of the Future" by the World Economic Form in 2019 for their progress in digitalisation, there are four steel mills, including two of Tata Steel’s. China is the digital accelerator, while the USA is still the incubator of digital concepts, according to automotive and China specialist Bill Russo. In his opinion, Europe is still too focused on its production strengths, particularly in the automotive industry. He believes the industry should be careful not to be left behind. In this context, Karl also appealed for a range of solutions instead of centrally-managed digitalisation models.

“Our vision of the future is a fully integrated ecosystem, fed by a flow of information between all stakeholders. We work hand in glove with leading institutions to advance and standardise these systems. Digitalisation of manufacturing and customer facing processes is one of the most important prerequisites for cost savings while improving overall equipment effectiveness,” he added.

-ends-

For further information:

Carlo Di Terlizzi, Tata Steel, F: +44 (0)1902 484215, carlo.diterlizzi@tatasteeleurope.com

Christiane Bourquin, about:communication, F: +49 (0)221 5341088 31, c.bourquin@aboutcommunication.de

About Tata Steel’s European operations

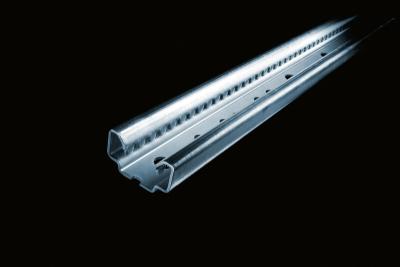

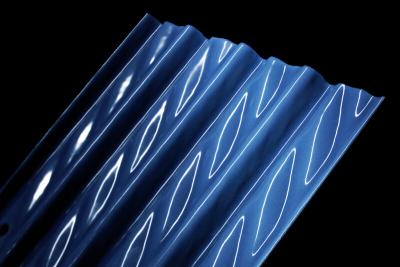

Tata Steel is one of Europe's leading steel producers, with steelmaking in the Netherlands and the UK, and manufacturing plants across Europe. The company supplies high-quality steel products to the most demanding markets, including construction and infrastructure, automotive, packaging and engineering. Tata Steel works with customers to develop new steel products which give them a competitive edge. The Tata Steel group is among the top global steel companies with an annual crude steel capacity of 34 million tonnes. It is one of the world's most geographically-diversified steel producers, with operations and a commercial presence across the world. The group’s turnover (excluding its South East Asia operations) in the year ending 31 March 2020 was US $19.7 billion.